Akhuwat Loan

Education

Akhuwat Foundation in Pakistan offers various types of loans aimed at supporting individuals and small businesses. The main types include:

Welcome to Children Charity

Akhuwat is a not-for-profit organization which was founded in 2001 on the Islamic principle of Mawakhat (مواخات) or solidarity. The concept of Mawakhat predates to 622 CE when Prophet Muhammad (Peace Be Upon Him) urged the residents of Medina (Ansars) to share half of their belongings with the Muhajirs (migrants) who were forced to flee persecution and migrated from Mecca to Medina.

Who we are

Beef pork loin filet mignon officia. Veniam incididunt fatback ground round dolor nulla officia velit eu duis tail.

What we do

Esse turducken elit salami tri-tip exercitation ea, t-bone cupim aliquip chicken ullamco tongue proident, boudin exercitation.

How you help

Ut beef ribs salami duis ut. Burgdoggen jowl turducken swine minim in anim eiusmod officia lorem bresaola consectetur tempor buffalo.

Feature Sponsor

Make a difference

IM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending

Individual Lending

However, decision of lending methodology depends upon the loan product as well as project specific requirements.

How your donate is invested

Well-designed plans and supports

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals that fulfill the eligibility criteria of scheme in order to facilitate them to meet their needs through interest free loans. In case of individual lending two guarantors will be provided by applicant for availing interest free loan.

Growth and development

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

Transition and growing independence

After initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with borrower and their guarantors.

Akhuwat has been working to eradicate poverty since 2001.

Akhuwat is a not-for-profit organization which was founded in 2001 on the Islamic principle of Mawakhat or solidarity. The concept of Mawakhat predates to 622 CE when Prophet Muhammad (Peace Be Upon Him) urged the residents of Medina (Ansars) to share half of their belongings with the Muhajirs (migrants) who were forced to flee persecution and migrated from Mecca to Medina.

Drawing inspiration from the generosity displayed by the Ansars, Akhuwat believes that if the same approach, where one affluent family embraces a less fortunate one is adopted today, inequality will be eradicated from the world.

Pierre Omidyar – Sponsor since 2012

Loan Requirement

Akhuwat Foundation in Pakistan offers various types of loans aimed at supporting individuals and small businesses. The main types include:

- Microfinance Loans: For small entrepreneurs to start or expand their businesses.

- Interest-Free Loans: Targeted at low-income families for essential needs like medical expenses or education.

- Housing Loans: To help individuals build or renovate homes.

- Agricultural Loans: For farmers to improve their agricultural practices or invest in equipment.

Youth Empowerment Loans: Specifically designed for young entrepreneurs.

Help a seriously ill child

Your $3 donation will provide a lifeline of support to a child, like Jack, who has a life threatening illness and his family when they need it most.

Support a family in need

No parent expects to outlive their child but for some families it’s a reality. $5 will help a family facing one of the toughest times imaginable.

Become a sponsor

Our Family Support Workers care for families at a time of great need. $10 will help families get the support they so desperately need.

Akhuwat

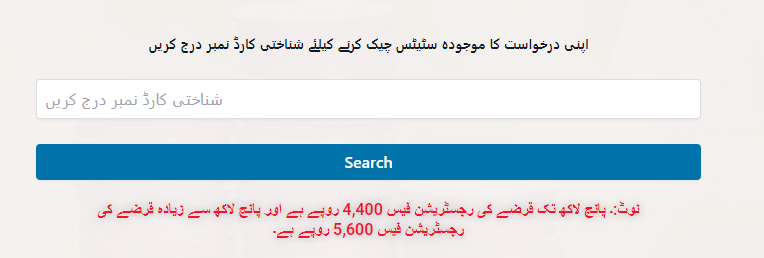

اخوت لون کے لیے درخواست دینے کے لیے، اپنے قریب ترین اخوت برانچ پر جائیں اور اپنا اصل شناختی کارڈ (CNIC) لے کر جائیں۔ درخواست فارم پُر کریں اور اس کے ساتھ CNIC کی کاپی جمع کرائیں۔ اخوت ٹیم آپ کی درخواست کا جائزہ لے گی اور اگر منظور ہو گئی تو آپ سے اگلے اقدامات کے بارے میں رابطہ کریں گے۔ یہ سادہ طریقہ آپ کو اخوت سے مالی امداد حاصل کرنے میں مدد دے گا۔

Eligibility Criteria for Loans

Following general points are compulsory for eligibility of loan:

Applicant should have valid CNIC.

Having the ability to run / initiate business activity having age between 18-62 years.

Applicant should be economically active.

Applicant should not be convicted of any criminal offence in lieu of which proceeding are in progress.

Applicant should have good social and moral character in his community.

Applicant should have capacity to provide two guarantors other than family members.

Applicant should be resident of operational area of branch office which might be around 2-2.5 KM radius.

Note: – Project specific eligibility criteria may be varied.

Lending Methodology

AIM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending

Individual Lending

However, decision of lending methodology depends upon the loan product as well as project specific requirements.

Group Lending

Group Lending includes disbursement of Qard-e-Hasan loans among groups of men and women who are looking forward to enhance their family income but are unable to do so due to scarce resources. In group lending methodology groups of 3 to 6 members will be formed, all group members would guarantee loans and credentials of each other. Group Lending enables group members to resolve their social and economic problems through mutual understanding and decision making.Before applying for a loan, applicant is supposed to constitute a group of 3 to 6 members residing nearby to each other and members shouldn’t be close relatives to each other.

Individual Lending

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals that fulfill the eligibility criteria of scheme in order to facilitate them to meet their needs through interest free loans. In case of individual lending two guarantors will be provided by applicant for availing interest free loan.

Application Submission

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

Applicant will visit nearest AIM branch along with his/her relevant documents (mentioned below) for submission of loan application.

Unit manager will discuss with the applicant to check whether applicant falls under eligibility criteria of the scheme.

Potential candidate will submit loan application on prescribed form. Loan application will be provided and filled by AIM staff in branch office.

Unit manager will check documents and application will be processed after completion of required documents.

The following are the details of collaterals that may be applied for loans:

1. Personal responsibility

2. Two guarantors

3. Postdated cheques

4. Any additional collateral in special case.

Following documents shall be submitted along with loan application:

Copies Of CNIC

Applicant (Mandatory)

Guarantors (Mandatory)

Family Member (Optional)

Objective

For Identification

For verification in Management Information System (MIS)

Bank Requirement for collecting money

Latest Utility Bills

Applicant (Mandatory)

Objective

For address verification

To assess Payment Behavior

Latest Photos

Applicant (Mandatory)

Objective

For identification

Copy of Nikahnama

Applicant (Mandatory) (may be waived if not available after verification by other means)

Objective

For identification in case CNIC of wife is not with the name of husband

Note: – Additional documents may be demanded according to scheme’s requirements.

Social Appraisal

Social appraisal aims to verify character and credibility of the applicant by visiting his residential place. After receiving the Application, unit manager performs social appraisal through following methods.

Information from existing borrowers

From the living style of the applicant

Views of neighbors about the applicant

Personal interview/ family interview

Business Appraisal

Through the scrutiny of business plans the business idea of the intended borrower will be evaluated to see if it is viable and whether it can generate income beyond the household expenses sufficient for loan repayment. Business requirement is evaluated in business appraisal. This will also help fine-tune the applicant’s business idea itself. The applicant’s family will also be interviewed to make sure that they know about the loan and support the business idea.

Second Appraisal:

After initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with borrower and their guarantors.

Fund Request & to head office

Once loans are approved by the LAC, the required amount of funds is requested to the Head Office through the Regional Manager. The head office makes necessary arrangements for transfer of funds.

Loan Disbursement

Disbursement takes place once a month and loans are distributed through an event usually held at a mosque or church. In case the individuals, lending applicant has to be accompanied by at least one guarantor. In case of group lending, all group members are to be present at the time of disbursement. Funds are transferred through Cash Over Counter (COC) facility, where beneficiary will visit the counter of concerned Bank and will receive the money. However, disbursement may also be made by direct transfer of money into respective bank account of beneficiary depending upon the nature of the project and amount of the loan. For disbursement purposes, any other verifiable mechanism may be adopted on the discretion of the AIM.